Today we're going to talk about form i-9 the federal form that employers use to verify the identity and employment eligibility of nearly all employees as a general rule US employers are required to complete and retain a form i-9 for each employee hired to work in the United States citizen or not it sounds simple, but there are a lot of questions surrounding i9 s and it as an employer you need to know the right answers welcome to HR / coffee a series from the experts at HR 360 where you'll learn how to effectively hire manage and terminate employees for my nine is a routine and required part of onboarding new employees the form is composed of three main sections' employee information and verification of identity and eligibility to work employ a review and verification of documents and a third section that is used when reverification or updates are necessary let's jump right in and take a look at some of the most common questions employers have regarding i9 forms do I need to complete i9 forms for independent contractors am I responsible for the authenticity of documents presented for verification what if there's a mistake on a nine AMI can I fire an employee who fails to produce the required documents how can I protect private information on form i-9 all right now let's answer these questions one at a time do you need to complete form i-9 for independent contractors or their employees the answer to this is no you don't need to complete form i-9 for independent contractors and any contractor you engage is responsible for completing the i-9 for its own employees however you may not use a contract to obtain the labor or services of an employee knowing that the individual is...

PDF editing your way

Complete or edit your Form I-9 2018 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export Form I-9 2018 directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your Form I-9 2018 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your Form I-9 2018 by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form I-9 2018

About Form I-9 2018

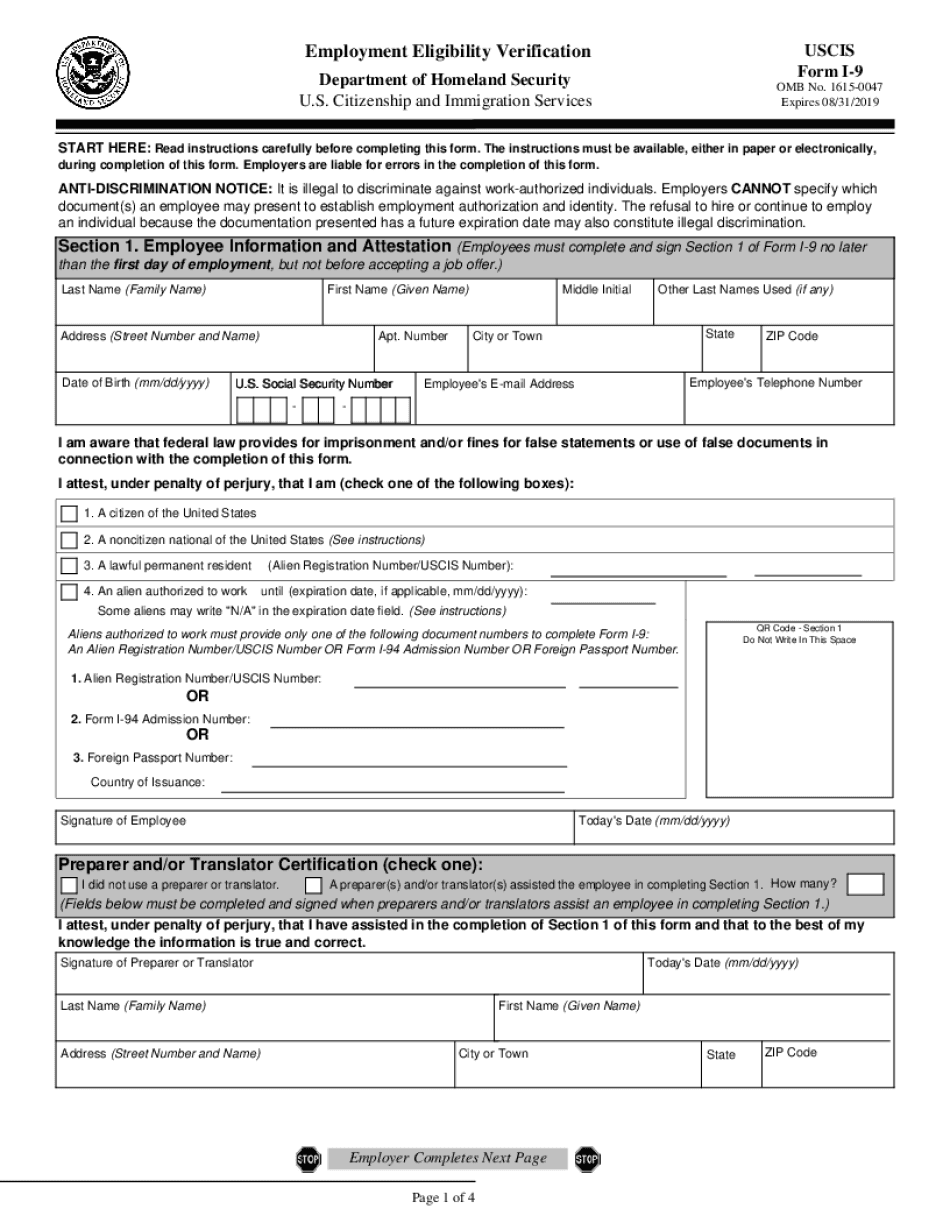

Form I-9 is an employment eligibility verification form that is used by employers in the United States to verify the identity and employment authorization of individuals they hire. The form was last revised in 2024 and is required to be completed for every employee hired in the country. Employers are responsible for ensuring that each newly hired employee fills out Section 1 of Form I-9 no later than their first day of work. The employer is then required to review the supporting documents provided by the employee to establish their identity and employment eligibility, and complete Section 2 within three business days of the employee's start date. All employers, including those hiring employees for agricultural labor or services, are required to complete and retain Form I-9 for each individual they hire for employment in the United States. This includes citizens and noncitizens. Both employees and employers must complete the form fully and accurately, as failing to do so can result in penalties and legal consequences.

What Is I-9 Form 2018

The Employment Eligibility Verification, Form I-9, is a United States Citizenship and Immigration Services document. Since 1986 this form is used to verify an employee’s identity with their employer. This is intended to control the legal authorization to work to all paid workers.

Due to the Immigration Reform and Control Act of 1986 that requires all employers to verify the new employees, workers have to complete the I-9 at the time of hire.

Note that the document is not required for independent contractors or unpaid volunteers. However, there may be some exceptions.

Which Version of The Form I need to Prepare?

There are some versions of the I-9 Form. The latest one was published by the U.S. Citizenship and Immigration Services on November 14, 2016. The 2024 template was acceptable until January 22, 2017. Since then only the I-9 2024 version can be used.

Learn the List of the Required Information and Documents

As an employee you have to fill out only Section 1. Section 2 has to be completed by the employer within three days of the worker’s starting date of employment. The superior has to ensure that the paper is filled out in time and is completed according to the requirements.

The worker has to indicate

- their personal information i.e. full name, address, date of birth;

- Social Security number;

- email address and contact numbers.

The new employee also has to prsome documents.

- The one that confirms identity and employment eligibility or

- The one that confirms identity together with another document that confirms employment eligibility.

Check Lists A, B and C of the Documentation for proof of identity or employment authorization to find out more details about the required papers.

Note that an alien who has the legal right to work in the United States has to prthe alien registration number or indicate Form I-94 admission number.

The prospective employee has to sign the I-9 2024 and add the current date.

Additional Points to Remember

It is critically important to pronly true details. False information may lead to fines and even imprisonment.

In case a person needs some help to prepare the document (because of disability, or young age), then the special individual assisting them has to specify his/her personal data and sign the form as well.

If a worker cannot properly read or write in English, a translator or preparer has to fill out the blank and sign it on behalf of the employee. Note that in this case the worker is required to add their signature as well.

Online methods assist you to prepare your doc management and enhance the efficiency of the workflow. Go along with the short tutorial for you to carry out Form I-9 2018, stay clear of glitches and furnish it within a timely method:

How to accomplish a Form I-9 2024 internet:

- On the website while using the form, click on Get started Now and go to your editor.

- Use the clues to complete the pertinent fields.

- Include your own info and get in touch with details.

- Make absolutely sure that you choose to enter appropriate data and quantities in acceptable fields.

- Carefully take a look at the information within the kind as well as grammar and spelling.

- Refer that will help area should you have any questions or address our Support workforce.

- Put an digital signature with your Form I-9 2024 while using the aid of Sign Resource.

- Once the form is concluded, press Undertaken.

- Distribute the prepared variety by way of email or fax, print it out or save on your gadget.

PDF editor permits you to make improvements on your Form I-9 2024 from any net linked system, customize it in keeping with your requirements, signal it electronically and distribute in several approaches.

What people say about us

The growing need for digital forms

Video instructions and help with filling out and completing Form I-9 2024